In the world of finance, small businesses often face unique challenges that require careful financial management. Whether you’re a seasoned financial accountant or a business owner looking to improve your financial practices, this guide will provide you with essential tips and insights to navigate the financial landscape of small businesses.

The Top ChatGPT Prompts for Accounting 2023

The Importance of Financial Accounting for Businesses

Financial accounting plays a pivotal role in the success of small businesses. It involves recording, summarizing, and analyzing financial transactions to provide insights into a company’s financial health. Effective financial accounting can help small businesses make informed decisions, secure loans, attract investors, and comply with tax regulations.

1. Keep Detailed Records

Accurate and comprehensive record-keeping is the foundation of sound financial accounting. Maintain records of all financial transactions, including sales, expenses, invoices, and receipts. Use accounting software or spreadsheets to organize and categorize this information.

2. Create a Budget

Think of a budget as a map for your money. It helps you figure out how to use your money wisely. Make sure to check your budget regularly and change it when you need to. Start by estimating your income and expenses for the coming year. Be realistic and include all potential costs, even unexpected ones.

3. Monitor Cash Flow

Cash flow management is crucial for small businesses. Keep track of money coming in and going out of your business. Ensure you have enough cash on hand to cover expenses, especially during lean months. Use cash flow statements to identify patterns and make necessary adjustments.

4. Separate Personal and Business Finances

Many small business owners make a mistake by using their personal money for business and business money for personal things. Keep them separate. Open a separate business bank account and credit card to avoid confusion. This separation simplifies accounting, aids in tax reporting, and protects your personal assets.

5. Stay Compliant with Tax Regulations

Tax compliance is a must for every business. Familiarize yourself with federal, state, and local tax laws that apply to your business. Pay attention to filing deadlines, deductions, and credits that can reduce your tax liability. If you’re not sure about taxes, it’s a good idea to talk to a tax expert. They can help you understand what you need to do.

6. Implement Accrual Accounting

While cash accounting is simpler, accrual accounting offers a more accurate picture of your business’s financial health. Accrual accounting records transactions when they occur, regardless of when the cash exchanges hands. Instead of just looking at money that comes in and out right away, accrual accounting looks at money when it’s earned or spent. This way, you get a better idea of your money over time.

7. Regularly Reconcile Accounts

Reconciliation is the process of comparing your financial records with external statements, such as bank statements or vendor invoices. Regular reconciliation helps identify errors, discrepancies, or fraudulent activities early on. It ensures your records remain accurate.

8. Analyze Financial Statements

Financial statements, including the income statement, balance sheet, and cash flow statement, are vital tools for assessing your business’s performance. Use these statements to identify areas where you can cut costs, increase revenue, or make strategic investments.

9. Plan for Financial Challenges

Small businesses often face financial challenges, such as seasonal fluctuations or unexpected expenses. Make a plan for what to do if something unexpected happens. This way, you’re ready for surprises. Establish an emergency fund to cover unforeseen costs without jeopardizing your business’s stability.

10. Invest in Financial Education

Staying informed about financial best practices is crucial. Consider attending workshops, webinars, or courses related to financial accounting. Continuously improving your financial knowledge will benefit both you and your business.

Best Chatgpt Prompts for Accounting Firms 2023

Best ChatGPT Prompts for Financial Accounting

| Prompt Number | Prompts |

|---|---|

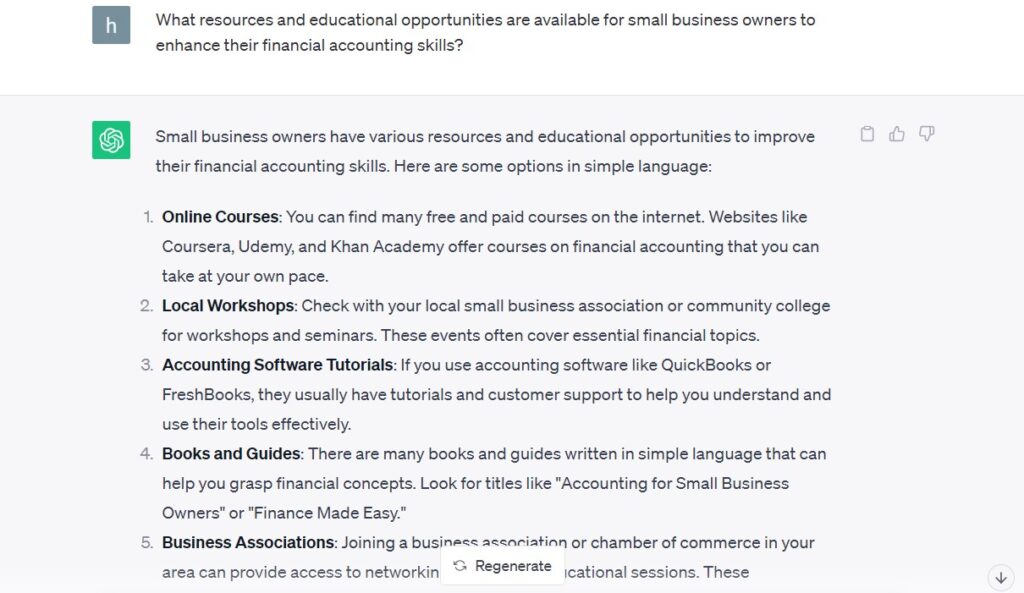

| 1 | What resources and educational opportunities are available for small business owners to enhance their financial accounting skills? |

| 2 | Share success stories of small businesses that have thrived due to effective financial accounting practices. |

| 3 | Explain the concept of depreciation and its impact on small business financial statements. |

| 4 | How can small businesses use financial forecasting to plan for future growth and challenges? |

| 5 | Discuss the ethical considerations in financial accounting practices for small businesses. |

| 6 | Explore the best practices for managing accounts payable and accounts receivable in small businesses. |

| 7 | What strategies can small businesses employ to improve their working capital management? |

| 8 | Discuss the importance of regular bank account reconciliation for small businesses. |

| 9 | Discuss the advantages of using accounting software versus manual bookkeeping for small businesses. |

Conclusion: Mastering Financial Accounting for Small Business Success

Financial accounting is a critical aspect of running a small business. By implementing these essential practices, you can strengthen your financial foundation, make informed decisions, and pave the way for long-term success. Remember that financial stability is a journey, and consistent efforts will lead to a brighter financial future for your small business.

Best ChatGPT Prompts for Tax Compliance Services in Accounting 2023

Why is it essential for small businesses to implement accrual accounting instead of cash accounting?

Accrual accounting offers a more accurate representation of a small business’s financial health compared to cash accounting. While cash accounting records transactions when money exchanges hands, accrual accounting records transactions when they occur, regardless of when the cash is received or paid. This method provides a better understanding of income earned and expenses incurred over time, offering insights into the business’s long-term financial performance. Accrual accounting is particularly valuable for businesses that want a comprehensive view of their financial situation and need to make strategic decisions based on revenue recognition and expense management.

Why should small businesses consider creating a separate bank account and credit card for their business finances?

Creating a separate bank account and credit card for your business finances is essential for several reasons. It helps maintain clear financial records, simplifies accounting, and aids in tax reporting. Additionally, it protects your personal assets from potential business-related liabilities. Keeping personal and business finances separate ensures financial transparency, making it easier to manage and grow your business effectively.

What is the importance of financial ratios in financial accounting?

Financial ratios are used to analyze a company’s financial health and performance. They help investors, creditors, and management assess liquidity, profitability, solvency, and efficiency, making informed decisions and comparisons with other companies.